It may be the year of the consumer duty, a decade after the milestone that was the Retail Distribution Review, but one aspect of the industry that broadly looks to remain unchanged for now is adviser charging.

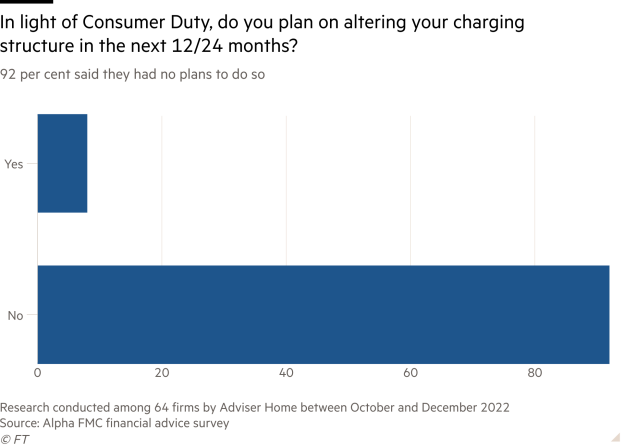

Exclusive research from consultancy Alpha FMC has found that, with regard to the consumer duty, nine in 10 advisers (92 per cent) have no plans to alter their charging structure within the next two years.

Although 92 per cent may seem like a high number, Nicola Butterworth, advice and compliance director at ValidPath, says the figure is about right.

“RDR back in 2013 was, I think, the point where every firm had to really look at their charging structure. That was the really big shift, going from primarily a commission-based industry, to having to justify your fees to the client because they were going to pay you directly.

“I think that was the big point where all firms went, ‘we have to know what we’re charging, why we’re charging, and the services that we’re providing because we have to have those conversations with clients’.”

With the industry having been through RDR, Butterworth adds: “I think adviser firms have generally got a charging structure that works for them and works for their clients. They can justify it, and they have to disclose their fees on a regular basis, because Mifid II means all the charges have to be disclosed every year.”

Bradley Northrop, head of the retail distribution and advice practice at Alpha FMC, agrees it is perhaps not that surprising to see that many firms are not looking to alter their charging structure in light of the consumer duty.

But he thinks this is because many firms have not yet undertaken the work around consumer duty to examine the way they charge in detail.

“We don’t believe the regulator is arbitrating on whether particular charging mechanisms, such as ad valorem fees, are the right structure. That decision is entirely down to the market and individual adviser firms to determine.

“However, what they are looking for is for advice firms to examine whether the price of the service is a reasonable cost compared to the benefits provided to the customer, both upfront and as part of an ongoing cycle.

“When they undertake this exercise, we expect firms will need to examine and, in some cases revise, their pricing structures to ensure this is more closely tailored to the different client segments they are serving.”

Overall, the focus is not on whether advice firms are looking to change their pricing model, adds Northrop. “But what is critical is how advice firms are documenting and evidencing price and value.

“There will be greater scrutiny on advice fees or total cost of ownership, so advice firms need to focus on developing the framework to define, evidence and monitor value going forward.