Royal London-owned fintech Wealth Wizards has launched its financial wellbeing service to the wider UK advice community.

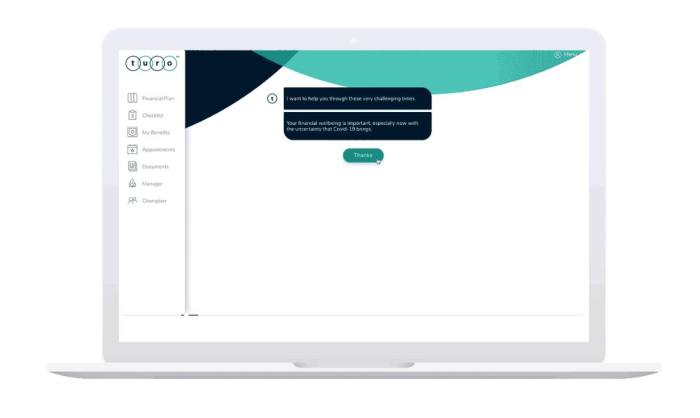

Called ‘Turo Wellbeing’, the service helps clients plan for retirement using guidance-only pathways rather than advice.

It is aimed at advice firms, as well as life assurers, banks and building societies.

The guidance starts with a set of questions reviewing nine areas of wellbeing. Clients are then encouraged to ‘play’ with the resources offered, which are designed to address each client’s challenges based on the data they input.

They can then take action in their own time, such as putting savings goals in place.

The service, which has only been rolled out to Royal London’s customers so far, is defined as a personal recommendation created by automated advice.

“We know from experience that consumers want easily accessible financial help and support, whether that’s guided outcomes, digital advice with some human oversight, or fully fledged regulated advice,” said Wealth Wizard’s chief commercial officer, Mark Kiddell.

“One of the valuable benefits of Turo Wellbeing is that it can offer both guidance and access to advice – via consumer-led and human-assisted experiences – depending on the consumer’s needs.”

Wealth Wizards spans both the advised and direct-to-consumer space. It has also integrated a ‘retirement hub’ for HSBC, and operates MyEva - a regulated, digital IFA which sits on Turo and is sold to employers.

The fintech firm was acquired by Royal London last year, and the mutual insurer is now a major customer.

“Royal London has invested capital in us. We’re well-funded now for the next period of the business. A lot of fintechs spend time raising money. But our owner frees up that time and gives us credibility in the market,” Wealth Wizard’s founder and chief executive, Andrew Firth, told FTAdviser.

In the past six months, Firth said the firm has won a “major client” since Royal London became an investor, but is yet to reveal the names of newly onboarded firms.

Sorting out ‘Middle Britain’

Currently, Wealth Wizards is focused on trying to close the advice gap with guided outcomes through its wellbeing offering.

“The advice gap is truly enormous. Just 4mn adults have an adviser. This is still a major societal problem,” said Firth.

“I’m a bit more sanguine about it. We’ve got a very well-established advice community, but we’ve got to get real - it’s focused on a wealthier segment. It’s focused on the top 10-15 per cent.