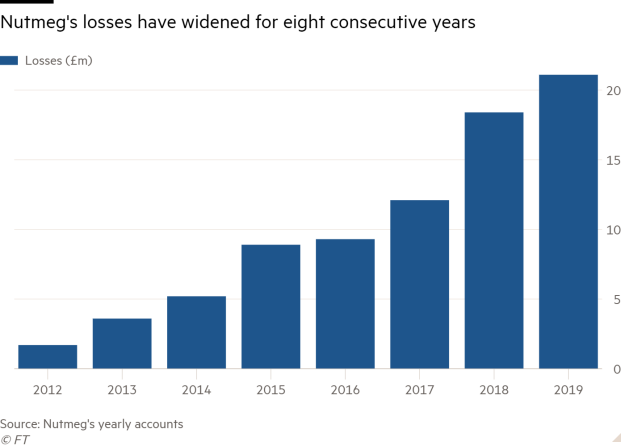

Losses at Nutmeg widened to more than £21m last year as the robo-adviser struggled to break even for the eighth consecutive year.

Accounts for the year to the end of December 2019, published on Companies House today (October 9), showed Nutmeg made a loss of £21.2m — an increase on the £18.4m loss reported for 2018.

It was the eighth year in a row that losses at the robo-adviser, which has never made a profit, have widened.

Its turnover has improved, however, from £7.1m in 2018 to £9.2m in 2019.

By the end of 2019, Nutmeg was managing more than £2bn assets under management for 80,000 UK clients — a 44 per cent increase in assets year-on-year — while its revenue grew by 30 per cent in the year to December.

In March 2019, Nutmeg looked to raise millions from its customers via a crowdfunding campaign to support the growth of the business.

Today’s accounts showed this had raised £3.8m and brought 2,000 new investors to the group.

In a strategic report accompanying the results, chief executive Neil Alexander said 2019 was “another successful year” in Nutmeg's journey.

He said: “We became the first wealth manager to offer customers the ability to top-up their investments using Google Pay and Apple Pay, and we developed our financial advice services to include financial planning to further help more people reach their financial goals.

“Despite an increase in competition, Nutmeg remains the largest digital wealth manager in the UK with 36 per cent share of the digital wealth management market and has grown to be the fifth largest wealth manager in the UK.”

Mr Alexander said the trading loss reflected the fact Nutmeg had continued to invest in the growth of the business.

Coronavirus boost

Nutmeg told FTAdviser it had seen a successful first half of 2020 as it benefitted from the accelerated adoption of digital services due to the coronavirus crisis.

In the six months to June, Nutmeg’s customer numbers soared to 95,000 — representing a 30 per cent year-on-year jump — while its revenue also increased by nearly a third.

Total assets under management stood at £2.3bn as at June 30.

Mr Alexander told FTAdviser Nutmeg had “benefitted from these changes in consumer sentiment and behaviour” with “faster than anticipated growth” in 2020 so far.

He said: “Coronavirus and the subsequent lockdown restrictions in 2020 have accelerated the adoption of digital services and fundamentally changed the way investors think about their investments and wealth management providers.

“While traditional providers are realising that being fit-for-purpose in a digital world is no longer a nice-to-have but is now essential.”

The robo-advice sector has in recent years attracted capital from large financial services firms such as Schroders, which backs Nutmeg, and LV, which backs Wealthify.

But some have not fared as well as expected. In May last year it emerged Investec was closing its Click and Invest robo-advice business following two years of losses while Moola shut its doors in January this year.