On March 19 2014, chancellor George Osborne stated that some 13m defined contribution savers were being railroaded towards buying an annuity with their pension savings, but this would end from April 6 2015 with the introduction of pension freedoms.

From the age of 55, people could access their savings to do what they want, when they want and without restriction, stated the chancellor. Mr Osborne made it clear to the world that no one would ever have to buy an annuity again.

While the government deliberated whether to include defined benefit pensions within the freedom reforms, there was a general election looming and any exclusion may have angered millions of DB scheme voters.

As a signal that flexibility of DB pensions was more complex, regulated advice for all safeguarded benefit pensions over £30,000 was introduced as part of the Pensions Act.

Key Points

- Pension freedoms created the context for DB transfers.

- Abridged advice is one option advisers can consider

- Some companies may take up abridged advice

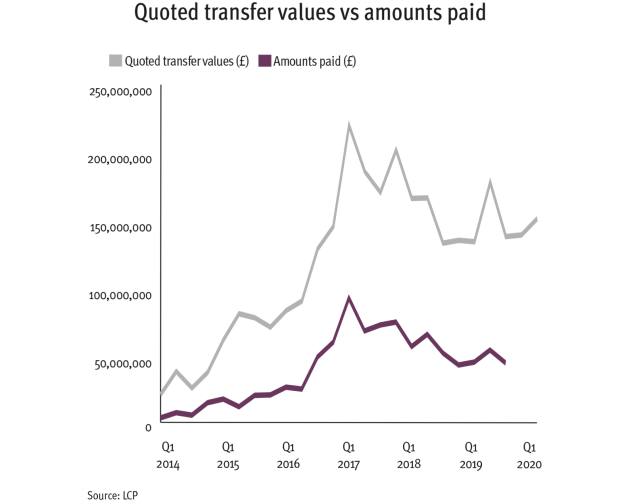

At the very same time, some DB pension schemes were offering their members attractive transfer rates, with some multiples reported to be in excess of 47 times the annual pension.

These schemes were trying to stabilise long-term pension liabilities by incentivising scheme members to transfer out. The approach carried a cost in the short term but made it easier for these schemes to plan financially in the long term.

Since this time, we have seen significant interest and demand to access DB pensions and despite the requirement for regulated advice, a new era of the insistent client has emerged, often simply wanting advisers to rubber stamp their decision to access the cash.

Although many advice companies use triage, which the Financial Conduct Authority supports employing, it also had concerns, saying: “When reviewing firms’ triage services, we have found that some forms of triage may be inadvertently crossing the advice boundary.

“For example, if an adviser… tells a client that it is unlikely that a transfer would be recommended if the client took regulated advice, this may be an implicit recommendation to stay in the ceding scheme.”

DB transfers have not been out of the news for the past five years and the issues surrounding the British Steel debacle have created significant focus and political pressure, forcing the regulator to take decisive action.

The latest FCA amendment to its rules for DB pensions has introduced the concept of “abridged advice”, which is an attempt to allow an element of individual advice into the triage service, without making it as costly as an in-depth financial review.

What is abridged advice?

The abridged advice service, which will be effective from October 2020, enables an adviser to:

• Provide the consumer with a personal recommendation not to transfer or convert their pension; or

• Tell the consumer that it is unclear whether they would benefit from a pension transfer or conversion based on the information collected through the abridged advice process. The adviser must then check if the consumer wants to continue to full advice and make sure they understand the associated costs.

The abridged advice process should only contain the initial stages of the full advice process: