Dunbar explains: “When we ask some of our youngest clients ‘where do you want to invest your pension; where do you want to put [your money]?’ they will typically give an answer such as, ‘I want to put it somewhere that is responsible’.”

He says that this kind of conversation has moved on from 20 years ago, illustrating how today’s younger generation is more clued up about their agency in investment for social and environmental change.

For Dunbar, older generations tend to have the wealth, but less will to invest responsibly. Therefore, there may be an opportunity to improve ESG knowledge by getting old and young in the same room, talking finance with each other.

He believes there is scope for advisers to do this, and to facilitate engaging conversations between younger people and older generations in a family to work out where to invest.

Advisers are in a good place to hold these conversations in family financial planning, and there may be more regulatory nudges towards this in the future.

Having the conversation

Tim Morris, IFA at Russell & Co, believes that having conversations about ESG with all clients is really vital. He says “I’ve included the ESG question for clients for quite a few years.

“It’s been part of our fact-find since last year. And now there is an in-depth questionnaire on our risk profiling tool. I have some clients who’ve been passionate about investing ethically for well over a decade.”

Recent research by consultancy the langcat in 2021 pointed to this. Its 30-page report, ‘Crossing the ESG Event Horizon’, showed advisers and clients are increasingly having conversations about ESG and sustainable investing.

According to the report, which featured YouGov research from more than 1,807 real-life consumers and more than 316 advice professionals, 42 per cent of advisers have a process in place concerning ESG requirements to assess suitability and bring this into the fact-finding discussions.

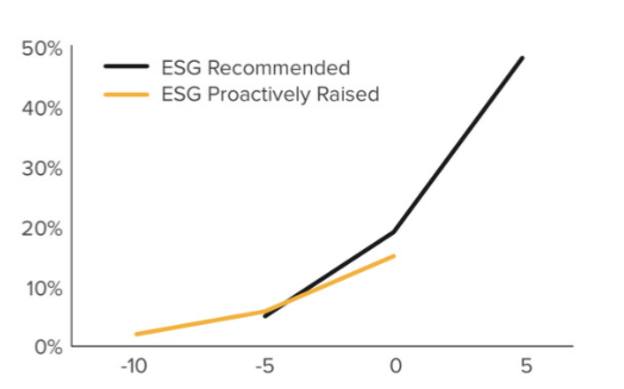

The graph below shows the rise in advisers actively discussing ESG with clients over the past 10 and five years, and predictions for the next few years.

Moreover, Morris says: “Clients have not had to sacrifice returns, and they have experienced a renaissance period in recent years, with a plethora of sustainable funds coming to market.”

Morris believes that ESG is not a hindrance, and at the very least provides a landscape where useful, constructive and probing questions can be asked to work out clients’ preferences and leanings.

Long-term solutions

Dunbar is passionate about the opportunities implicit in applying ESG to investment portfolios.

He says: “We don’t think about growth and value but about timeframe. It’s an element in this conversation, because those companies that are going to benefit from opportunities in the E and S space are the growth companies.