With its rarefied lingo of Series A rounds, burn rates, angels and unicorns, venture capital isn’t normally seen as an asset class for the person in the street.

And yet, over the past 25 years in the UK, tens of thousands of people who would not know an IRR from an IPO have become VC investors.

They have done this through venture capital trusts (VCTs), the first of which was launched almost exactly 25 years ago.

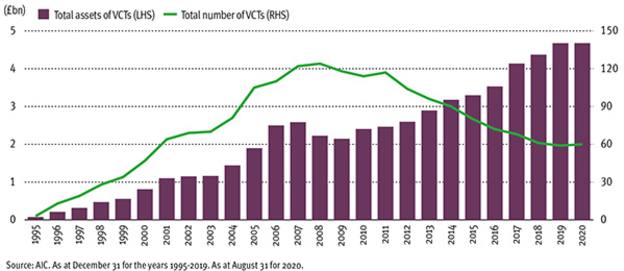

Endorsed (if occasionally revamped) by every occupant of 11 Downing Street since Ken Clarke, VCTs have grown into a £4.7bn industry – enough to make them a major player on the European venture capital scene. The aptly named Octopus Titan VCT, with assets of more than £910m, is the eighth biggest venture fund in Europe.

Risks and reinvestment

Though investors can subscribe for VCT shares directly, this is predominantly an advised market. Advisers have been attracted by a powerful combination of tax breaks, the best known of which is the 30 per cent upfront income tax relief, but there are tax-exempt capital gains and tax-free dividends available as well.

These incentives have become even more enticing since the tapering of the pension annual allowance for higher earners. In the four tax years since that change, VCTs have raised an average of £655m a year, up from £394m in the four prior years.

While the upfront income tax relief at 30 per cent is as close as maxed-out pension savers can get to pension tax reliefs, a stream of tax-free dividends looks an attractive prospect to supplement the income from a pension.

Key Points

- Tens of thousands of people have become VCT investors

- The VCT sector is predominantly advised

- There are fewer VCTs available than 10 years ago

But are advisers in danger of letting tax breaks determine investment choices? And, given their risks, are venture capital investments really a suitable supplement to a pension?

The risks of VCTs are self-evident. The whole point of the scheme is to support businesses that would otherwise struggle to secure funding for growth, and changes to the VCT rules since 2015 have narrowed the focus on high-risk/high-return opportunities.

These companies can become big names – over the past quarter-century, VCTs have backed the likes of Zoopla and Secret Escapes – but they can also fail completely.

But this risk is mitigated by an unusual feature of VCTs. Like their close cousins, investment trusts, but unlike institutional VC funds, most VCTs are evergreen – they reinvest the profits that they do not pay out in dividends.

This means that at any one time, a typical VCT will be invested in dozens of underlying businesses from a range of sectors, at different stages of development.

Smooth returns

VCTs invest in sectors as diverse as medical imaging, video games, enterprise software, niche consumer brands and quantum computing.

And of these businesses, some will be new investments, with ink barely dried on the deal, while others may be in the process of being sold – with most somewhere in between.

This diversification of both business sector and ‘maturity’ means that it is possible for VCTs to produce smoother returns than you would expect from a more conventional venture capital investment.