Risk and volatility are two words that are central to the investment management process. While they are often used interchangeably, in reality they mean very different things.

Peter Fitzgerald, multi-asset investor at Aviva Investors, defines the difference as follows: “Risk is about a permanent loss of capital, volatility is about the propensity of the price of an asset to move up or down frequently.”

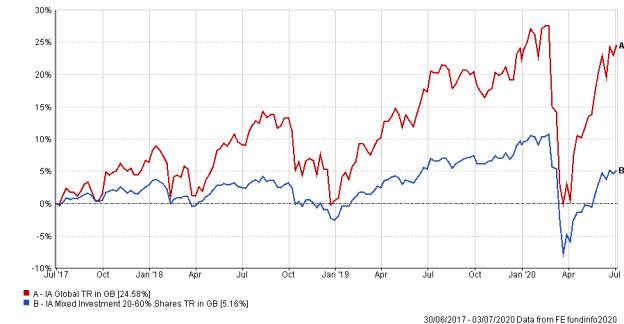

Dan Kemp, chief investment officer at Morningstar, notes that volatility is required to help investors generate a return.

He says: “The problem is when markets are volatile, lots of different assets, good and bad, fall in price sharply, and that scares investors.

"But actually, it is from that volatility that opportunities arise. Without volatility, prices wouldn’t fall, and there would be [better] investment opportunities. Investors who try to time the market or are short-term in outlook don’t get the benefit of volatility, and instead experience loss of capital.”

As a result, there is a difference between low volatility and low risk.

Low volatility

David Coombs, head of multi asset investing at Rathbones, says many assets appear to have little volatility but are in actual fact among the riskier assets on the market.

He says: “Low volatility should not be confused with an assumption that assets are also low risk."

He points to alternative assets, in particular as an area where the two terms can be mixed up.

"As we have seen recently in some sectors such as student housing, aircraft leading, infrastructure and property - all often found in multi-asset portfolios to act as a volatility dampener – what seemed a low volatility way to secure income has seen huge hits to value.

"However, investors should not get into the habit of focusing on the volatility of each line item in their portfolio – this is totally irrelevant. What matters to us, if we build a portfolio that offers real diversification, is that the correlation of the assets will drive the appropriate portfolio volatility.”

He said an investor that focuses excessively on having a low volatility portfolio might find themselves in a position where the assets have little volatility, but also deliver low returns.

Robin Geffen, global equity fund manager at Liontrust, sums this up a different way. He notes the lowest volatility investment on earth is to simply put money into a drawer. Doing this, of course, means sacrificing any possibility of making a return from an investment.

In alternatives, products such as student property funds, which own assets that are not priced on a daily basis, can seem to have little volatility - because without movement of the underlying assets, there may be little reason for the fund price to move.

That creates the impression that there is little volatility in the asset class - until a major event happens and the market news the value of the underlying investment to fall in value, causing a swift, and sharp drop in the value of the fund.