From the minute Donald Trump walked into the US election arena, he was to many ‘a man of distinction, a real big spender’. And in the words of the famous song, many Americans decided they wanted to ‘spend a little time’ with him in their lives.

At the core of Mr Trump’s message was the idea that the US should spend more on itself, should make more for itself, and should improve its neighbourhoods.

Not restricted by elected office, Mr Trump could say what many Americans were thinking. Their bridges were decaying, their roads were potholed, their water supply was not pure enough, and their energy was too expensive. He said it was time to spend on doing them all up.

This message was often drowned out by his much more contentious comments on migration and walls.

He was also aware of the impact of low incomes and the competitive conditions in much of the labour market, which makes living to a preferred standard difficult for many Americans.

The US allows them to dream the dream, but earning the money to fulfil the dreams can be difficult. This made him a fan of tax cuts for all, with promises to take many more lower-paid people out of income tax altogether, and a 12 per cent tax for the starter rate.

It also meant he backed plans to change Obamacare, which has hiked health insurance premiums for many Americans on modest pay.

Mr Trump is not easy to pin down in conventional political terms. His plans to spend much more on infrastructure appears similar to Democrat policy. His aim to cut taxes is more Republican.

The question of whether he is a deficit dove or not is difficult to prejudge. While Mr Trump wants $1trn (£806bn) more spent on infrastructure, this is over a 10-year period and it also assumes substantial increases in private sector investment.

Many of the items he wants built can be paid for by user charges, rather than by taxes. His offer of a large tax cut to US corporates is designed to get them spending and investing more. His one-off offer of a 10 per cent corporate tax rate to bring home profits kept offshore is also designed to boost the available pool of cash for substantial investment in the domestic economy.

Mr Trump and his advisers will claim that lower tax rates will boost activity, generating a positive effect on tax revenues to offset some or all of the tax lost from lower rates. With around $2trn of profits sitting offshore, success in getting some of this sent back to the US would also help bridge any loss of revenue from overall lower rates.

With the new administration planning to spend more public money on ‘doing the place up’, some of this capital will be generated from the increasing tax revenue resulting from a bigger economy.

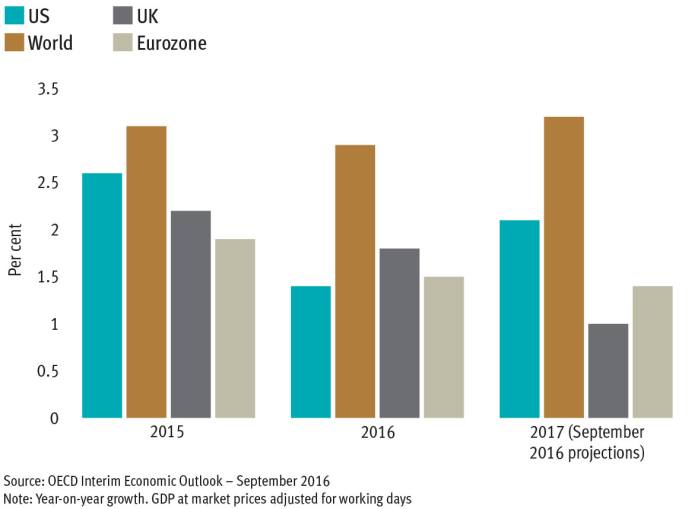

Mr Trump is ambitious in his plans. He wants to boost the growth rate in the US from around 2 per cent to 3.5 per cent or even 4 per cent. Were he to achieve a 2 per cent gain in output each year, that would mean the US collectively could spend around $400bn extra each year. That would mean higher incomes for many Americans, and more US-produced goods and services.