Last Friday morning was relatively calm, the UK gilt market was ready for a "mini" Budget that was to contain an energy price announcement and some tax changes, which were likely to result in additional supply of government debt.

The promise to households to help them through a tough winter would need to be funded via the issuance of gilts, and 10-year yields had risen from 3.1 per cent to around 3.5 per cent through the week leading up to Friday morning.

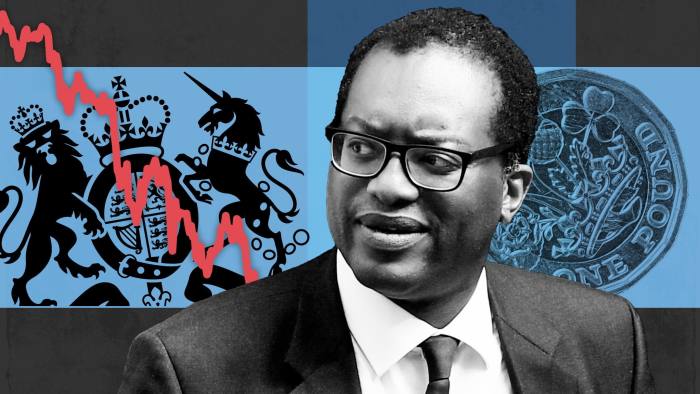

The "mini" Budget would be one for growth, and the chancellor indicated it would lead to a 2.5 per cent trend rate of real GDP growth over the medium. There were more tax cuts than had been anticipated, which surprised the economics profession and the market, the details of which are well documented elsewhere.

The Debt Management Office was expected to issue around £130bn of government bonds this fiscal year. Following the "mini" Budget, gross issuance is now expected to be closer to £190bn and in the following fiscal year, it could be closer to £220bn.

Remember that the price to the government/taxpayer of the energy price cap is open-ended and the ultimate cost of this policy will be dependent on the price of gas in the wholesale markets, this year and next.

That seems significant, even if it stood by itself – and it does not. Aside from the question of whether these measures will indeed create 2.5 per cent real GDP growth over the medium term, the fundamentals do not present an overwhelming attractive proposition for investors buying these new gilts – 25 per cent of the gilt market is held in foreign hands.

Unfunded cuts to government revenue; substantial additional supply into a market that has already had a very challenging year; the Bank of England being due to commence selling gilts back into the market; and, of course, very high levels of inflation were all set against a backdrop of a forecast imminent recession.

These are just some of the reasons why the gilt market fell on Friday following the Treasury’s announcement – the 10-year yield marched higher closing the day at 4.1 per cent.

Over the weekend market participants digested the news while the chancellor seemed to double down on the bet, suggesting in interviews further tax cuts would come in due course. Consequently, the selling pressure continued at 8am on Monday and through Tuesday, with yields on the 10-year gilt reaching 4.5 per cent.

Bond prices are more sensitive to changes in yields if they have a longer maturity. The longest nominal UK bond matures in 2073 and the trading price for this bond fell more than 30 per cent between Friday morning and Wednesday morning.

The inflation-linked equivalent also maturing in 2073 has more sensitivity to yield changes due its longer duration and the price of this instrument fell 62 per cent over the same period as yields surged.