As we stand here at the middle of the 2017, the environment facing investors remains somewhat challenging.

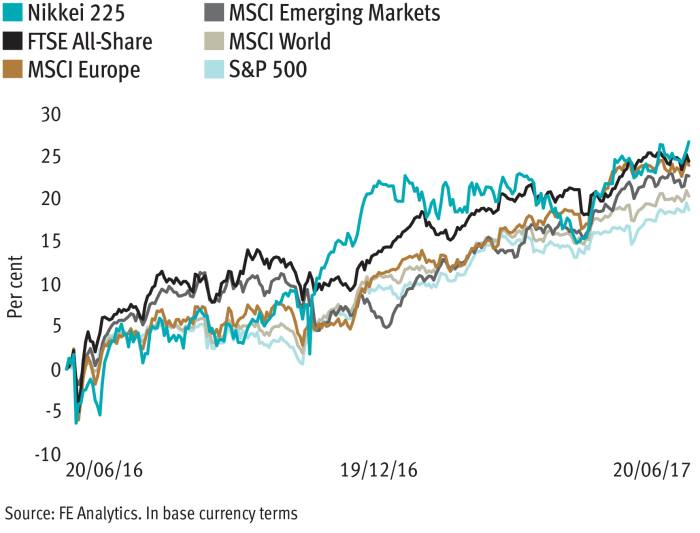

While equity market performance so far this year suggests all is rosy in the world, there are still a number of dark clouds on the horizon, both in the UK and globally. There is what we have called the battle between positivity and pessimism.

In the UK the main obstacle is, unsurprisingly, Brexit. There are undoubtedly many major challenges to be faced by the UK in these negotiations – a number of previous trade talks have taken multiple years to agree, even for countries producing a far less diverse range of goods and services than the UK. A successful agreement in just two years is going to be a huge challenge.

Despite this sterling has rallied this year on rising expectations of a smoother negotiation. This seems quite optimistic, particularly considering prime minister Theresa May’s poor relations with senior EU figures. We therefore have growing concerns for the UK economy for the remainder of 2017. There are signs of a weakening consumer, with wage growth being eroded by the return of inflation.

While the manufacturing sector might be performing well, it is a far smaller percentage of the economy than consumption. However, we are cautiously optimistic on the outlook for UK equities, particularly given that a weaker sterling is providing a boost to overseas revenue streams.

The outlook for European equities also looks positive, as the clouds that have hovered over the continent seem to be gradually drifting away. Europe is still viewed pessimistically by many participants in the market, but beyond the noise the underlying fundamentals appear to be improving on a daily basis.

Europe has now posted 14 consecutive quarters of growth, with unemployment falling back into single digits and job creation hitting a nine-year high. Business sentiment is also at its highest point for six years.

This begs the question of why investors are still cynical towards Europe. Similar to many other occasions in recent years, the answer can possibly be found in politics. Europe has, for the moment at least, seemingly avoided the rise of the populist movement, with far-right candidates defeated in both the recent Dutch and French elections.

While there remain question marks surrounding the health of the Italian banking system, as well as renewed concerns about the economic stability of Greece, the market has rallied on more positive political news – such as the election of Emmanuel Macron in France – and hence further growth should come.

Another source of pessimism can be found across the Atlantic, as investors try to understand the unusual political situation surrounding president Donald Trump. While some of Mr Trump’s planned policies are seen as growth friendly, he has so far been unable to pass any major reforms and is seemingly losing some support from Republican Party colleagues.