Emerging markets dodged the equity fund flow exodus in September, a month in which stocks and shares funds as a whole experienced record outflows.

Figures from the Investment Association published last week (November 7) showed emerging markets enjoyed £296m worth of net inflows in September 2019 — the most for more than a year, and the only IA equity category to receive more than £1m of positive flows.

Technology and telecoms received £1m of net inflows throughout the month but every other category saw net outflows, with UK All Companies and Europe ex-UK the biggest laggards £462m and £255m of outflows respectively.

The amount of money invested in emerging markets made the sector the fourth ranking sector in terms of inflows in September.

| Ranking | Net retail sales | £m |

| 1 | Strategic bond | 721 |

| 2 | Mixed investment | 347 |

| 3 | Global bonds | 315 |

| 4 | Emerging markets | 270 |

| 5 | Emerging markets bond | 270 |

| 6 | Volatility managed | 224 |

| 7 | Flexible investment | 128 |

| 8 | Short term money market | 127 |

| 9 | Property | 84 |

| 10 | UK index linked gilts | 76 |

Jason Hollands, director of communications at Tilney, said the inflows into emerging markets was down to the fact they were seen as the “value opportunity”.

He said: “Emerging markets are currently trading at a discount so although the overall trend is people pulling money out of equities, the bargain hunters will be looking at emerging markets as an opportunity.

“It will be where the contrarians are putting their money — in a risky market where valuations are more appealing.”

Mr Hollands said concerns about the global trade war had put a cloud over emerging markets but the fact there was potential for an agreement in December meant the markets could “rally quite hard”.

Paul Stocks, director at Dobson & Hodge, agreed, adding investors could also be looking to diversify outside of the UK market due to political uncertainty. He said emerging markets had experienced a "good year" so far.

Data from Morningstar showed just three funds were responsible for 60 per cent of the net inflows into emerging markets, with the £2.2bn iShares Emerging Markets fund leading the way as investors put £94m into the portfolio.

The fund has returned 45 per cent over the past five years, compared with an IA Global Emerging Markets Sector average of 43 per cent.

The £320m BlackRock Emerging Markets fund received £34m, while £32m was invested in Fidelity's £2.5bn equivalent.

The BlackRock fund has returned 60 per cent over five years, while the Fidelity fund has returned 56 per cent over the same period.

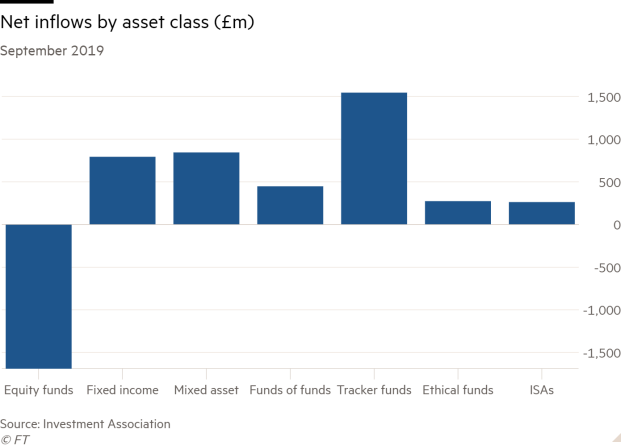

Equity funds overall were the only asset class to suffer net outflows in September, with a hefty £1.7bn withdrawn. In terms of fund structures, tracker fared best as investors piled almost £1.6bn into the passively managed portfolios.

The Investment Association said equity funds notched up a record quarter in terms of outflows, totalling £4.6bn in the three months to September.

Chief executive Chris Cummings said: “Global uncertainty cast a long shadow over stocks and shares in the last quarter and savers particularly shied away from UK equities with £2.3bn of outflows in the same period.

“Bond funds benefited as investors looked for a port in the storm, with mixed asset funds also providing relief.”